July 11, 2024

Smart Strategies for Investing While Living Abroad: An Extensive Guide

Introduction

Investing While Living Abroad

For the great number of people who move abroad, either to work, study or for pleasure, saving and investing can be a great challenge. You're embracing a new employment system, grappling with a brand new tax regime and often dealing with complicated bureaucratic or local government systems, all in a foreign language.

Despite the challenges, however, it's vitally important to continue to cultivate the good financial habits that you've cultivated at home, even after moving. Give yourself both a short amount of time and budget as a grace period to settle in, but beyond that, you should be sticking to the same principles that have yielded you so much success so far.

Why Invest While Living Abroad?

Exploring the Benefits of International Investment

Living abroad can be a great opportunity to gain exposure to international investments. You should take the opportunity while living in a new country to both immerse yourself in the culture, and the financial landscape of that country. How can you do so? Well, by participating in the country's economic growth.

Of course, this is generic advice - it's impossible to be specific without considering both the country and one's personal circumstances, but the notion is the same.

Securing Your Financial Future While Enjoying a Global Lifestyle

Many people move abroad in order to maintain their salary while living in a much lower cost of living area. Which is completely fine and within your rights - but you should be aware of both being respectful of the new country's norms and customs, and help stimulate its growth by spending and investing there.

Understanding International Investment Options

What to do with your Cash

The first thing to note is that you should make sure you stick to your 3-6 month emergency fund, exactly as you did before. It is very important to note that this should be kept in a regulated bank account. Which sounds obvious, but a number of the multi-currency bank accounts you see, particularly those from challenger banks, are not actually regulated banking authorities. Which means you may not have the same level of recourse if your money were to go missing, or something were to happen to your account.

The implications of this are potentially incredibly serious - you don't want to be stuck in a foreign country far away from home with no money and no ability to get access to emergency supplies.

So choose a regulated bank - perhaps a traditional old brick & mortar bank to have your salary paid into and a savings account with, and a faster and easier to use digital bank for money transfers, day to day spending and budgeting.

One way of improving your habits here is to also remember to set up automatic transfers between these accounts each month, which will allow you to continue your good habits from home with minimal stress and friction.

Stocks, Bonds, and Mutual Funds: What’s Best for Expats?

The advantage of these instruments is that they are available globally, and not restricted to the market in which you reside. That means that you can continue to invest in the same mix of stocks, bonds and funds that you were choosing before the move.

Your broker shouldn't be geographically limited either, which means that you will be able to continue putting money into the same account.

There are a few exceptions to this, but in most cases, the asset will be held in the base currency of its country anyway, so what currency you put in won't really matter. For example, US stocks are denominated in US dollars, so whether you're paying in British pounds or Euros, the asset will be held in dollars.

Real Estate Investment Opportunities in Foreign Markets

Now property is a little bit more complicated - obviously it is geographically restricted, which means that it will be locked to the area that you buy. You can gain exposure to a country's property market either directly by buying a residential, rental or commercial holding there, or by investing in an REIT (real estate investment trust) based in that country.

The former is better for specific investments where you either want to hold a property to live in, can manage it yourself of have some level of business exposure to the country.

The latter is better if you are looking to build up a diversified portfolio of investments in that country, and real estate makes up a portion of these. Many people like the reliable and cash-flowing nature of real estate investments, and their brick and mortar nature makes them a comforting place to put money.

Diversifying Your Portfolio with International ETFs

It goes without saying that you will want to keep a diverse portfolio of assets, as you would in your home country. Now the thing is, you probably have a reasonably good global allocation of investments already, so moving country simply changes the input currency, rather than the actual holdings inside.

If that isn't the case, now is a great time to start thinking about your geographic allocation, which is something that can be managed on the Strabo dashboard.

Navigating Tax Implications for Expats

Key Tax Considerations for Overseas Investors

It is vitally important to do the requisite tax planning for your jurisdiction. There may, in fact, be tax advantages to working away from your home country. Some countries have far reaching requirements for resident non-domiciled workers, whereas some simply leave you to file taxes in the new area.

Regardless, you will want to compare the tax rates before moving and use this to weight your relative salary and purchasing power in each place.

Managing Currency Exchange Risks

What about Currencies

Currency fluctuations can have a big impact on your savings and investments. Depending on which country you're in and whether it has a stable currency, large swings in short periods of time can devalue your salary and living expenses significantly. For this reason, we advise that you save and invest directly in the currency linked to your long-term plans.

For example, if you're buying a property overseas, to save for it in that currency to avoid uncertainties around that currency.

The Strabo Dashboard

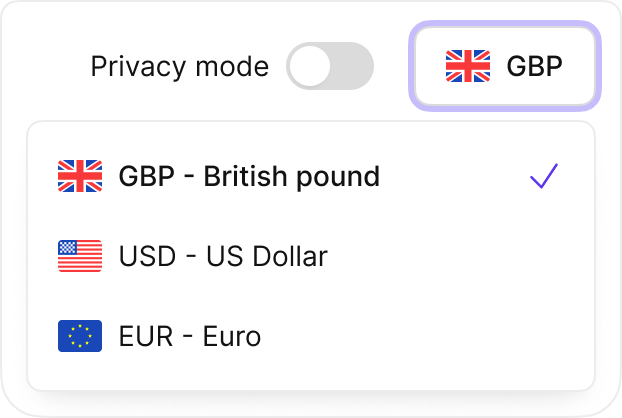

We've specifically built the Strabo dashboard to have a currency switcher with live updates of every currency in the world, in order to make managing your finances across different countries as seamless as possible. You can choose a base currency for your dashboard and then switch between others at the click of a button, as shown below.

Many of the most popular and major countries also have linked account coverage, which means that you can sync your bank accounts seamlessly in their base currency, and have them either on your accounts page or in a custom page in a new currency of your choice. Check it out!

Strategies for Minimising Currency Fluctuation Impact

We would avoid trying to time currency changes - it is an endeavour that is challenging even for the most sophisticated investors, and trying to time moves never really tends to end well. That being said, you can certainly choose periods of less volatility between currency pairs, usually dictated by calm macroeconomic conditions.

In essence, try and make any big money transfers in times of peace and quiet - much better to repair the roof when it's dry than when it's raining!

Choosing the Right Financial Advisors and Brokers

Finding Reputable Financial Advisors with International Expertise

As with your home country, it can be difficult to find trustworthy financial advisers. With that in mind, our advice would be to take professional advice for taxes and accounting, and beyond that try and continue your strategy from home - it is unlikely that this will be much different at all, and you can easily fall into the pitfall of taking unecessary advice from expensive wealth managers who are only interested in taking a cut.

Leveraging Technology to Manage Your Investments Abroad

Make the most of resources like Reddit, use your Strabo dashboard and as always just try and do your research before jumping into any decisions. It has never been easier to understand how things work in other countries than it is today.

You can also join forums specifically for internationals - many have sections dedicated to that country, and are welcoming to inquisitive new members interested in learning about the laws and customs of their new home.

.png)

Conclusion: Tips for Successful International Investing

Building a Diversified International Investment Portfolio

We've said it loads of times before, but the principles of investing remain the same wherever you are in the world. Most problems come from people trying to do things that are too elaborate.

Save a solid proportion of your income, keep an emergency fund, maximise your pension contributions and invest what's left into tax advantaged accounts, split between diversified blue chip assets. Makes it sound so easy!

All jokes aside, you should try as hard as possible to keep simple, automated financial systems that act as guard rails, and this is even more important in a new place where you have new currencies and laws to deal with on top of the added personal stress.

Common Mistakes to Avoid When Investing as an Expat

The one exception to this is US expats - they have much more onerous requirements when it comes to reporting and filing taxes. Even expats not earning money in the US are required to file US tax returns, and we would suggest taking professional advice before moving from the US, or at least when you land.

Beyond that, give Strabo a try! It can be incredibly confusing managing money across different countries, and we've spent a long time both suffering from this problem and thinking deeply about a solution. Make the most of it! As always, you can let us know what you think directly by email, on socials, on our community forum or even using the in-platform chat.

Why Use Investing Apps in the UK

Investing is now simpler than ever thanks to these applications, which get rid of the need for pricy brokers or complicated procedures. Investing apps like Trading 212, Freetrade, and Revolut make it possible for young and beginner investors to take control of their investments with their user friendly interfaces, built in educational tools and minimal or no costs.

As the need for low cost investing options and financial independence continues to grow, the UK is expected to utilise mobile investing tools even more in 2025. More people in the UK are using apps to manage their money as a result of its adaptability, simplicity of use, and the growing trend towards digital financial solutions and increased awareness of personal financial planning, which makes investing apps an effective tool for beginner investors.

Benefits of Using Investing Apps for Beginners

- Accessibility - By providing a straightforward, mobile friendly platform that is available at anytime and from any location, investing apps have completely changed how individuals invest. You no longer have to spend hours learning complicated systems or setting up sessions with financial experts. Beginners can begin investing directly from their smartphones with a few taps. Anyone, regardless of their schedule or location, can participate in investing without any obstacles thanks to this immediate access.

- Low cost - The affordability of investment apps is one of their most notable benefits. The high commissions and administration costs associated with traditional broking services make it challenging for those starting out to invest small amounts of money. On the other hand, a lot of investment apps provide cheap fees or commission free trading, which makes them perfect for beginners. This enables beginners to invest without fear of losing a significant amount of their profits to fees, allowing them to give more money to the market.

- Adaptability - Traditional investment strategies are not as flexible as investing apps. Beginners can more easily dabble without making a significant upfront payment because many investment platforms enable users to invest in a variety of assets, stocks and shares, exchange traded funds (ETFs), and specialised investment options, allowing beginners in the UK to diversify their investment portfolios right away. Furthermore, everyday investors may manage their investments on their own terms and are not restricted to a 9 to 5 schedule thanks to the option to trade at any time and from any location.

Manage your wealth like never before

Key Features to Look for in an Investment App for Beginners in the UK

- East to use interface

The design of the app should be simple and intuitive. You will find it easier to comprehend and utilise the platform without feeling overwhelmed if it has a straightforward and uncomplicated layout. - Educational Resources

The best investment apps include educational materials such as FAQs, videos, tutorials, and articles. Beginner investors can use as a guide to understand important investment strategies and make wise choices. - Platform fees

A lot of investment apps charge management fees and trading fees. To protect your investment gains, it's crucial for beginners to select an investment app with little to no costs. The best investment apps waive management fees or provide zero commission trading. - Low minimum investment

For beginners who might not have a large initial investment, apps that let you start investing with small amounts of money are excellent. Also look for apps that sell fractional shares, so you can invest in pricey stocks without having to purchase the entire share. - Portfolio diversification tools

Seek for investment apps that provide a variety of investment options, including mutual funds, index funds, and exchange traded funds (ETFs). Even with little money you can create a diversified portfolio by making a fractional investment in individual stocks. - Robo-Advisor Features

Some investment apps include robo-advisors which automatically manage your investment portfolio according to your goals and risk tolerance. For those whose may not feel comfortable choosing their own investments, this is a fantastic benefit. - Security features

It is important to ensure that the app has strong security features like encryption, two-factor authentication, and safe account recovery methods to protect personal data and information. - Current market data

The best investment apps have real time market data, charts and stock market performance metrics which are essential for beginners who wish to remain informed and make wise judgements. - Type of investment accounts

There are many types of investment accounts available, such as investment accounts for minors, individual retirement accounts and individual taxable accounts. You should choose an investment app that provides you with a range of account options that can help meet your financial objectives.

Further reading

Investing

May 30, 2025

What Happens When You Short a Stock and How Can You Do It?

This is the summary of the blog post on shorting a stock

Company Updates

May 16, 2022

Why We're Crowdfunding

Read more about our decision to launch a Crowdfund with Seedrs

Investing

May 2, 2023

What is the Best Crypto Portfolio Tracker

Discover how to use Strabo and other tools to track your crypto portfolio across platforms

Investing

November 19, 2024

Why is there a Crypto Surge and What Does it Mean for my Portfolio

With crypto prices rising across the board, let's take a look at what this means for your portfolio

Investing

February 14, 2022

Why a Bear Market Might be a Good Thing for Crypto Investors

A downtrend in crypto markets could prove to be a good thing in the long term. Here's why

Investing

July 14, 2022

What is Responsible Investing and Why It Matters: ESG Funds

A brief introduction to impact investing for consumers

Saving

December 3, 2022

Why Energy Prices are Rising: A Brief Explanation

A brief look into the increase in energy prices in the UK

Saving

June 22, 2022

Why is Petrol so Expensive in the UK in 2022?

It is now more expensive than ever to fill up your car. But why?

Company Updates

March 5, 2024

What we learnt from launching on Product Hunt for the first time

Launching Strabo on Product Hunt

Investing

June 14, 2023

Where Should You be Buying Stocks: The UK's Top Brokerage Accounts

Find out which is the best brokerage account to open in the UK this year

Investing

September 9, 2024

What Metrics Should I be Tracking in my Investment Portfolio

Find out what you should be looking for when tracking your portfolio

Saving

August 28, 2024

What is the 100k Tax Trap and How Can You Avoid It

A dramatic effective tax increase awaits. Find out what to do when it hits

Saving

December 3, 2022

What is Inflation, and Why Does it Matter?

Discover how rising prices come about and what they mean for you

Saving

June 29, 2024

Prepare Yourself for Unexpected Expenses: How to Plan for the Future

Get ahead of any large upcoming costs before they affect you

Investing

August 17, 2022

Modern Portfolio Theory: Real-World Applications

Discover how MPT can be applied to your investments

Saving

February 21, 2025

Top 10 Best Apps for Saving Money UK: Boost Your Savings Effortlessly

Find out which ones you should download today

Saving

January 31, 2022

The Top 5 Bank Accounts for Digital Nomads

Which should you use when moving abroad

Guides

March 2, 2024

The Top 5 Financial Planning Tools Used by Advisors

Which software can help you improve your clients' experience

Guides

May 11, 2023

The Property Investment Guide

Learn about getting started with property investing with Strabo

Investing

June 21, 2024

The Top 10 Financial Trends to Watch in 2024

Here's what you should be paying attention to for the upcoming year

Financial Independence

December 8, 2022

The Pros and Cons of an Increased Workplace Pension Contribution

Should you increase your pension contributions or invest elsewhere?

Investing

September 26, 2024

The Future of Finance: 10 Key Fintech Trends Shaping 2024 and 2025

Here's what to pay attention to in fintech in the coming years

Guides

March 14, 2023

The Financial Planning Guide

Your detailed guide to personal financial planning

Saving

April 7, 2023

The ISA: Part 1 - What is it, and How Should I Be Using It?

What are the different types of ISA and how can you use them as an effective tool?

Investing

December 15, 2022

Fear and Greed Index: What It Is and Its Market Impact

Measuring how much fear and greed is affecting market prices

Saving

December 3, 2022

Best Savings Account for International Students Abroad

A resource to compare savings accounts for UK students abroad

Saving

June 14, 2024

The Cost of Marriage: Effects of a Wedding on Your Financial Life

Calculate how much your wedding might cost you

Investing

October 28, 2022

Portfolio Risk Analysis: Measuring Investment Vulnerability

How to measure and react to the risk in your investment portfolio

Guides

April 3, 2023

The Capital Gains Tax Guide for the UK

A simple guide to capital gains tax in the United Kingdom

Saving

May 2, 2022

The Cheapest Digital Nomad Locations: Where to Go on a Budget

Tips for moving abroad from the Strabo team

Investing

February 22, 2024

The Best Investment Options in UAE

Tips for investing in the UAE from the Strabo team

Saving

April 4, 2022

Create Budgets: Best Finance Apps in Australia for You

Tips for saving money if you're in Australia

Investing

August 2, 2024

The Best Digital Asset Management Software for the United Kingdom

Today we're breaking down the best software to manage your assets

Saving

December 16, 2022

The Best Finance Apps for Couples: Manage Your Money Together

Try out Strabo or one of the other apps designed for couples to manage their finances

Investing

March 7, 2022

The Best Investing App in Europe: Find Out Which One is Right for You

Look no further - a breakdown of the best investing apps for Europeans

Investing

April 18, 2022

The Best Bank Account for UK Landlords

A brief exploration of what makes a good bank account if you have rental property

Investing

February 14, 2025

What is Mean Reversion, and How Can Investors Use It?

Taking a deeper look at one of the most important statistical concepts in investing

Saving

May 9, 2022

Best Bank Account for Expats & Digital Nomads: Bank Stack

How best to manage your money strategically across countries

Company Updates

January 14, 2024

Strabo is Live! 5 Lessons learned from a Public Software Launch

Key learnings from a public SaaS product launch

Saving

December 3, 2022

The 2022 UK Budget Announcement: Everything You Need to Know

Key headlines from this mornings red suitcase

Investing

May 2, 2023

Startup Investing Part 1: When and How

Is it a good idea to put your investment capital into early stage companies?

Investing

April 4, 2023

Startup Investing Part 2: Venture Capital, EIS and VCT

A follow up on investing in early stage companies

Saving

June 27, 2024

Preparing Your Savings for a Baby: How Much Does it Cost?

Helping you make one of the most important personal decisions in your life

Financial Independence

June 30, 2022

Should I Put All My Pensions Together?

Helping you decide if separating or combining your pensions is the right choice for you

Investing

August 5, 2022

Should You Invest in Gold and Silver?

They're huge asset classes, but are they worth your money?

Investing

July 11, 2024

Smart Strategies for Investing While Living Abroad: An Extensive Guide

An expat's help guide for investing abroad

Investing

November 30, 2022

Rental Property: The Best Buy to Let Mortgages for First Time Buyers

How to finance your first rental property

Company Updates

June 6, 2022

Risk Appetite vs Risk Tolerance: How They Should Impact Your Portfolio

Understanding risk: one of the most important aspects of personal investing

Saving

July 4, 2022

Paying Down High-Interest Debt: Avalanche vs. Snowball

Are you in debt? If so, this repayment strategy blog is vital for you

Guides

October 1, 2024

Maximize Your ISA Allowance: Top Tips for UK Investors 2024/25

Make the most of your £20k allowance this year

Guides

December 3, 2024

Master Wealth in 2024: Smarter Strategies for Your Finances

A categorical summary of top strategies for the year

Saving

June 23, 2023

Managing Debt: Smart Strategies for Borrowing and Repayment

Get a hold over your debt and how best to complete repayment

Investing

December 4, 2024

Is Dumping $230K into the S&P 500 All at Once a Bad Idea?

Learning how to invest a lump sum

Financial Independence

July 29, 2024

Making the Most of Your Pension Pot: Tips for New Savers

Get a grip on your pension with Team Strabo

Guides

July 10, 2024

Making the Most of a Gift or Bonus: A Practical Guide

Learn the responsible way to manage a lump sum

Saving

March 14, 2022

Is there a Multi Currency Personal Finance App?

Discover cross-border investing with a multi currency finance app

Financial Independence

December 3, 2022

Is Passive Income Possible Through Dividend Investing

Capture company earnings with strategic dividend investing

Investing

August 22, 2024

Investment Strategies in the UK: What You Need to Know

Explore practical strategies to become the best investor you can

Investing

April 24, 2023

Investing in US Stocks from the UK: A Finance Guide

Capturing upside from the US stock market

Investing

December 3, 2022

Investing Strategies for Market Turmoil

Navigate the inevitable market disruption with a proper strategy

Saving

June 1, 2022

I Have No Savings at 30: What do I do?

Don't panic - let's look at your financial situation

Investing

June 10, 2022

Investing During a Bear Market: Tips to Protect Your Portfolio

Navigate market turmoil with a robust investing strategy

Investing

June 27, 2022

Investing in Hated Sectors: Do Sin Stocks Outperform Others?

Sin stocks have the potential to be volatile and risky. But do they outperform the market?

Investing

October 28, 2023

How to Use Chat GPT as Your Personal Finance Assistant

Leverage AI to improve your investing strategy

Financial Independence

January 26, 2024

How to Use a Side Hustle to Boost Your Income

Discover how a side hustle can supplement your income and net worth

Saving

October 18, 2024

How to Prepare for the 2024 Budget

Discover the highlights from the latest red suitcase

Investing

December 3, 2022

Choosing the Best Stocks for Long-Term Investment: A Guide

How to build a portfolio that endures for the long term

Investing

September 18, 2024

How to Buy Shares Online in the UK: A Step-by-Step Guide

Get started investing in shares today

Saving

June 19, 2024

How Much to Spend on Holidays Per Year

Budget for this year's holiday now

Saving

August 22, 2022

How to Budget and Invest on an Irregular Income

Smooth your freelancer income

Saving

May 6, 2025

How to budget for a Holiday

Plan your expenses for this year's holiday today

Financial Independence

February 18, 2025

How Much Should I Be Saving for Retirement? A Practical Guide

Planning your income and expenses for the later years in life

Financial Independence

February 8, 2023

Fire Movement UK: The Financial Independence, Retire Early Movement

Discover FIRE with Strabo

Saving

January 20, 2023

How Many Bank Accounts Should You Have in the UK?

Set up your bank stack with the help of Team Strabo

Company Updates

June 7, 2022

How Crowdfunding Works for Startups

Discover fundraising tips from Team Strabo

Saving

December 3, 2022

How Best to Navigate the UK Tax Code: Your Guide for Consumers

Paying tax in the UK can be confusing. Here's our short guide

Saving

January 21, 2024

Clever Ways to Save Money When You Get A Pay Rise

Make the most of that extra cash each month

Investing

September 7, 2022

Futures and Options: What are They, and How to Trade Them

Learn about some of the more esoteric ways to invest with Strabo

Guides

July 16, 2024

Useful Expat Tax Advice: Maximise Savings & Avoid Penalties

Make the most of overseas tax regimes today

Saving

November 1, 2024

Do You Need an AI Financial Assistant?

Using modern AI to augment your personal finance management

Investing

August 11, 2022

Electric Vehicle Stocks are on the Rise: Should You Invest?

Discover investing potential in the financial markets' latest trend

Financial Independence

November 29, 2022

Do You Need a SIPP & What are the Withdrawal Rules?

Using a Self Invested Personal Pension to accelerate retirement savings

Financial Independence

June 20, 2022

Do You Need a Global Wealth Manager

A brief guide to using a cross-border financial adviser

Investing

September 6, 2024

Cryptocurrency vs. Stocks: what’s the difference?

Learning the fundamental difference between two of the most important asset classes

Financial Independence

July 24, 2024

Detailed Breakdown of Pension Schemes in the UK

Learn about the different types of UK retirement accounts

Investing

August 16, 2024

Choosing the Top Real Estate Management Software in the UK

Manage your rental properties more effectively with specialist software

Investing

August 13, 2024

Cheapest Way to Buy Shares in the UK: A Practical Guide

Learn how to get started investing in stocks in the United Kingdom

Saving

December 3, 2022

Chancellor's 2022 UK Budget Announcement: The Update

Discover updates from this year's red suitcase

Saving

October 13, 2024

Cash Flow Planning: How to Draw From Your Portfolio

Withdrawing money from your portfolio in the most effective way

Investing

March 1, 2023

Calculate Your Investment Portfolio Diversification With Strabo

Use our handy tool to figure out how diverse your portfolio is

Guides

August 8, 2024

Budget of Paris Olympics 2024: Costs, Funding, and Economic Impact

Learn about some of the key financials behind this year's biggest sporting event

Investing

February 27, 2025

Best Investing Apps for Beginners UK: Top Choices to Start Your Investment Journey in 2025

Learn how best to get started with your first investment with Team Strabo

Guides

November 7, 2024

Balancing Holiday Expenses with Long-Term Goals in Your 30s

How best to split your spending between work and play

Guides

October 11, 2024

11 Essential Financial Calculators to Simplify Your Finances

Start using Team Strabo's favourite tools today

Investing

August 2, 2022

Portfolio Construction Begins with Asset Allocation: A Guide

Learn how to allocate your funds effectively between assets

Investing

November 12, 2024

Achieve Your Financial Goals in Your 30s with Strabo AI

Leverage our AI financial assistant to get the most out of your portfolio

Investing

July 8, 2022

10 Tips for Contracts and Tenants for Your First Rental

Avoiding the most common pitfalls with your first investment property

Financial Indep

September 12, 2024

10 Effective Tips to Get Your Finances on Track

Get the basics right with Team Strabo